Lawrence County Property Tax Rate . commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. comptroller of the treasury. This rate is applied per $100 of the assessed value. This value does not represent the market value. Taxable property is divided into two classes, real. appraise, classify, and assess all taxable property in lawrence county. we are responsible for putting a value on real property for tax purposes. the county legislative body sets the tax rate annually. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card.

from www.privateschoolreview.com

for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. comptroller of the treasury. Taxable property is divided into two classes, real. the county legislative body sets the tax rate annually. appraise, classify, and assess all taxable property in lawrence county. This value does not represent the market value. we are responsible for putting a value on real property for tax purposes. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. This rate is applied per $100 of the assessed value.

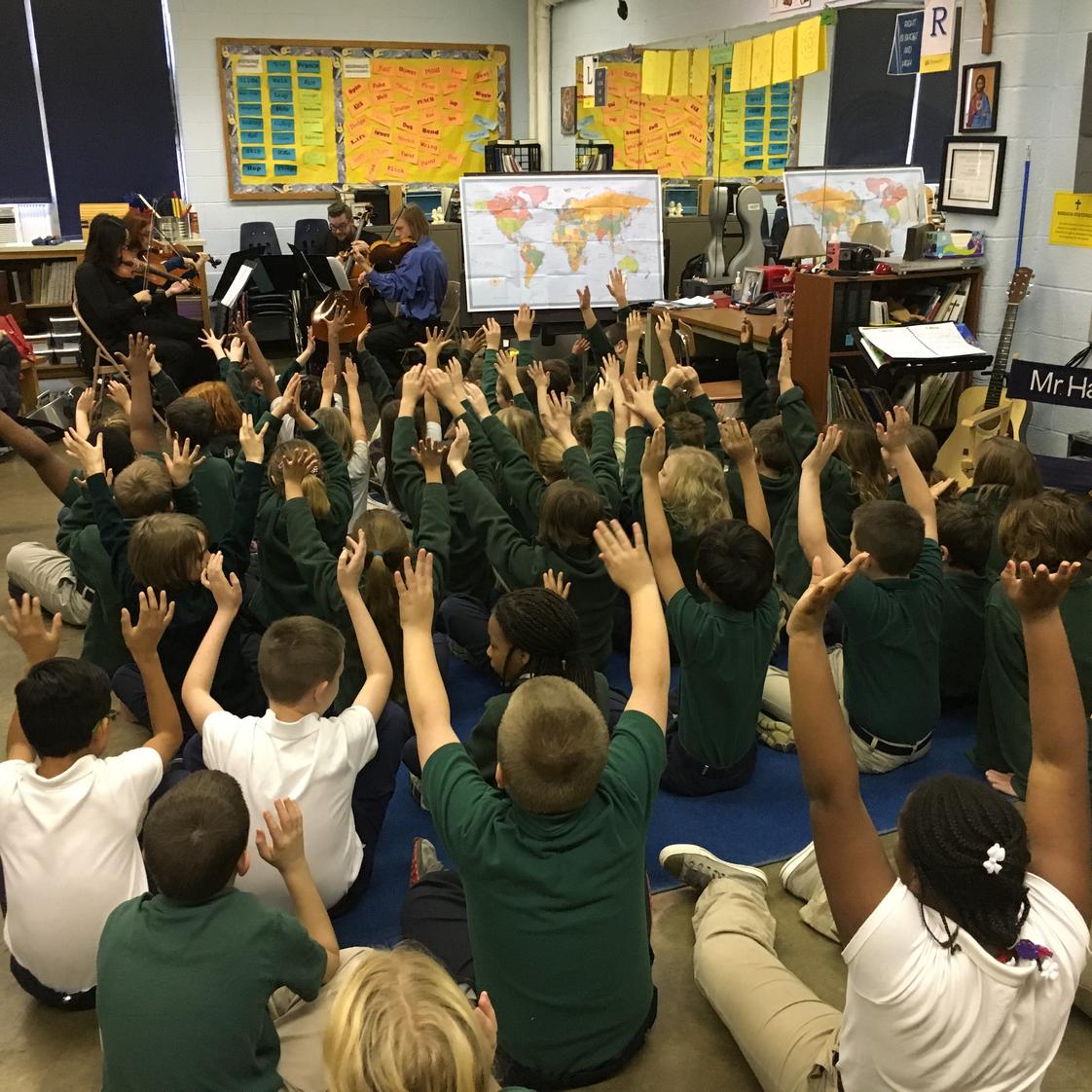

St. Michael School (Top Ranked Private School for 2024) Muncie, IN

Lawrence County Property Tax Rate the county legislative body sets the tax rate annually. This value does not represent the market value. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. Taxable property is divided into two classes, real. This rate is applied per $100 of the assessed value. we are responsible for putting a value on real property for tax purposes. appraise, classify, and assess all taxable property in lawrence county. the county legislative body sets the tax rate annually. comptroller of the treasury. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a.

From www.enterprise-journal.com

Search continues for missing Lawrence County man The Enterprise Journal Lawrence County Property Tax Rate appraise, classify, and assess all taxable property in lawrence county. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. This rate is applied per $100 of the assessed value. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. Taxable property is divided. Lawrence County Property Tax Rate.

From thebigsandynews.com

Medical Cannabis not put on November ballot for City of Louisa — The Lawrence County Property Tax Rate appraise, classify, and assess all taxable property in lawrence county. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. This value does not represent the market value. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. comptroller of the treasury. Taxable. Lawrence County Property Tax Rate.

From www.wwnytv.com

70 people in St. Lawrence County have coronavirus, 8 are hospitalized Lawrence County Property Tax Rate This value does not represent the market value. the county legislative body sets the tax rate annually. appraise, classify, and assess all taxable property in lawrence county. Taxable property is divided into two classes, real. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. we are responsible for putting a. Lawrence County Property Tax Rate.

From www.sothebysrealty.com

19690 Lawrence Road Fairhope, Alabama, United States Home For Sale Lawrence County Property Tax Rate the county legislative body sets the tax rate annually. This rate is applied per $100 of the assessed value. appraise, classify, and assess all taxable property in lawrence county. Taxable property is divided into two classes, real. comptroller of the treasury. for your convenience, you can now pay your lawrence county kentucky property tax bills with. Lawrence County Property Tax Rate.

From news.yahoo.com

St. Lawrence County man arrested after police chase ends in crash Lawrence County Property Tax Rate comptroller of the treasury. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. This rate is applied per $100 of the assessed value. we are responsible for putting a value on real property for tax purposes. This value does not represent the market value. commissioners approved the. Lawrence County Property Tax Rate.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Lawrence County Property Tax Rate comptroller of the treasury. the county legislative body sets the tax rate annually. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. appraise, classify, and assess all taxable property in lawrence county. we are responsible for putting a value on real property for tax purposes. Taxable property is divided. Lawrence County Property Tax Rate.

From www.lczephyr.org

Lawrence County Council budget at record 36 million in 2024https Lawrence County Property Tax Rate the county legislative body sets the tax rate annually. comptroller of the treasury. This value does not represent the market value. This rate is applied per $100 of the assessed value. Taxable property is divided into two classes, real. we are responsible for putting a value on real property for tax purposes. appraise, classify, and assess. Lawrence County Property Tax Rate.

From www.privateschoolreview.com

St. Michael School (Top Ranked Private School for 2024) Muncie, IN Lawrence County Property Tax Rate appraise, classify, and assess all taxable property in lawrence county. This value does not represent the market value. the county legislative body sets the tax rate annually. comptroller of the treasury. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. Taxable property is divided into two classes, real. This rate. Lawrence County Property Tax Rate.

From brandyyanneliese.pages.dev

Turner County Fair 2024 South Dakota Karie Marleen Lawrence County Property Tax Rate appraise, classify, and assess all taxable property in lawrence county. we are responsible for putting a value on real property for tax purposes. the county legislative body sets the tax rate annually. Taxable property is divided into two classes, real. comptroller of the treasury. This rate is applied per $100 of the assessed value. This value. Lawrence County Property Tax Rate.

From www.wwnytv.com

Property taxes drop under St. Lawrence County’s proposed budget Lawrence County Property Tax Rate This rate is applied per $100 of the assessed value. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. appraise, classify, and assess all taxable property in lawrence county. we are responsible for putting a value on real property for tax purposes. This value does not represent the. Lawrence County Property Tax Rate.

From www.yahoo.com

Live K10 traffic updates Delays, accidents in KC, Johnson County Lawrence County Property Tax Rate This rate is applied per $100 of the assessed value. This value does not represent the market value. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. Taxable property is divided into two classes, real. comptroller of the treasury. commissioners approved the state’s recommended rate of $2.01 per. Lawrence County Property Tax Rate.

From brownellabstract.com

Brownell Abstract Watertown, NY Lawrence County Property Tax Rate This value does not represent the market value. we are responsible for putting a value on real property for tax purposes. This rate is applied per $100 of the assessed value. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. for your convenience, you can now pay your lawrence county kentucky. Lawrence County Property Tax Rate.

From www.uslandgrid.com

Lawrence County Tax Parcels / Ownership Lawrence County Property Tax Rate comptroller of the treasury. the county legislative body sets the tax rate annually. appraise, classify, and assess all taxable property in lawrence county. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit. Lawrence County Property Tax Rate.

From nettymelany.pages.dev

Iowa State Tax Rate 2024 Ted Lexine Lawrence County Property Tax Rate comptroller of the treasury. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. the county legislative body sets the tax rate annually. we are responsible for putting a value on real property for tax purposes. This value does not represent the market value. appraise, classify, and assess all taxable. Lawrence County Property Tax Rate.

From allawn-blog.blogspot.com

Lawrence County Mo Vital Records Allawn Lawrence County Property Tax Rate Taxable property is divided into two classes, real. comptroller of the treasury. This rate is applied per $100 of the assessed value. the county legislative body sets the tax rate annually. This value does not represent the market value. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. we are. Lawrence County Property Tax Rate.

From mapsforyoufree.blogspot.com

St Lawrence County Tax Map Maping Resources Lawrence County Property Tax Rate appraise, classify, and assess all taxable property in lawrence county. This value does not represent the market value. commissioners approved the state’s recommended rate of $2.01 per $100 of appraised property value, a. we are responsible for putting a value on real property for tax purposes. for your convenience, you can now pay your lawrence county. Lawrence County Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Lawrence County Property Tax Rate comptroller of the treasury. for your convenience, you can now pay your lawrence county kentucky property tax bills with a credit/debit card. This value does not represent the market value. appraise, classify, and assess all taxable property in lawrence county. Taxable property is divided into two classes, real. the county legislative body sets the tax rate. Lawrence County Property Tax Rate.

From lawrencecounty.illinois.gov

Lawrence Lawrence County, Illinois Lawrence County Property Tax Rate we are responsible for putting a value on real property for tax purposes. This value does not represent the market value. comptroller of the treasury. the county legislative body sets the tax rate annually. appraise, classify, and assess all taxable property in lawrence county. for your convenience, you can now pay your lawrence county kentucky. Lawrence County Property Tax Rate.